Sign up for our LAVY email

and get our bi-monthly newsletter.

The COVID-19 pandemic, which has defined so much of how consumers view nearly everything in 2020, has most definitely had a significant impact on attitudes related to healthcare. There is no single viewpoint, however, and numerous factors play into how members of each segment are reacting. For example, even though overall trust has increased in medical professionals and decreased in media and elected officials, there are distinct differences based on political leanings.

With such a strong political influence, how do healthcare marketers walk a tightrope on messaging that appeals to all?

Attitudinal segmentation research helps health marketers target patients based on their distinct feelings and beliefs about healthcare. Similar to political leanings, attitudinal segmentation groups patients who share similar attitudes and feelings, allowing healthcare marketers to speak to what they commonly believe.

As the global pandemic was reaching its peak, we asked 500 of our original survey participants to answer some additional questions related specifically to COVID-19. Our goal was to learn how attitudes have changed both overall and for the four segments our prior research identified

This is the first of two COVID-19 Pandemic Amended Research Light-Bulb Moments.

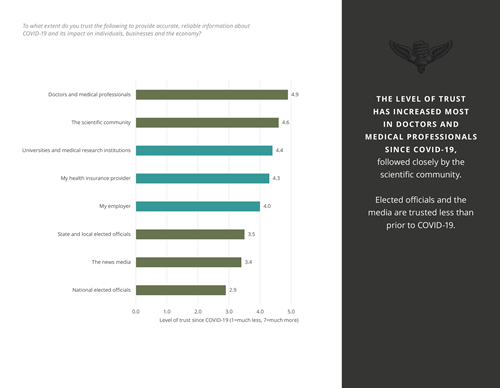

The level of trust overall has increased most in doctors and medical professionals since COVID-19, followed closely by the scientific community. On a scale of 0 to 7, with lower numbers representing much less trust and higher numbers indicating much more trust, respondents overall ranked their level of trust at 4.9% for doctors and medical professionals.

The same group reported a trust level of 4.6% for the scientific community.Meanwhile, our proprietary research shows, elected officials and the media are trusted less. And, furthermore, political leanings also factored into the equation.

Here’s how attitudes ranked during the pandemic among specific segments we identified in the pre-COVID-19 phase of research:

At the time of our pandemic research (May 2020), 29% of respondents said they would be comfortable engaging in normal healthcare activities.

Most, however, said they would be more comfortable doing so in another six to 10 months, between November 2020 and March 2021.

Most, however, said they would be more comfortable doing so in another six to 10 months, between November 2020 and March 2021.

Only 4% of respondents said they would not be comfortable returning to normal healthcare activities until the second half of 2021. This group was a subset made up of Boss respondents, of whom the majority at 10% reported not being sure when, with 9% each stating a preference for the first half of 2021 or when a COVID-19 vaccine becomes available. Another 6% of Boss respondents said they would be comfortable doing so sometime during winter.

Our research uncovered additional insights such as whether consumer attitudes have changed regarding considering an assisted living facility in the future and the impact of availability of a COVID-19 vaccine on their level of comfort.

It’s more than we can share here.

However, we’re happy to bring you up to speed. All you have to do is ask.

Chances are, you now see the value in switching from demographic research to attitudinal research for your upcoming marketing projects.

Going it alone, especially in a COVID-19-pandemic market, can be risky for healthcare marketers in 2020 and beyond. More than ever, choosing the best agency to partner with for consumer health care marketing messages has never been more important.

Consumer attitudes are changing, and you need an experienced team with significant industry experience combined with access to developing consumer insight based on what your patients believe.

You’ll find just that, and so much more, with LAVIDGE.

In fact, health care marketing is a core category at LAVIDGE. We invest in primary research to keep abreast of consumer shifts in the health care industry.

For example, in 2016, we launched our first healthcare research study and published the results in 2017. We followed up by publishing an entire content suite of healthcare-related advice on how to apply the information to a host of marketing and advertising services from Publicity to Media to help industry players achieve their goals.

Our current study digs deeper and provides updates on what’s most important to healthcare consumers today.

Finally, because our strong roster of current and past clients represents a wide range of organizations in the healthcare category including Banner Health, Blue Cross Blue Shield, Delta Dental, SimonMed Imaging, Sonora Quest Laboratories, and TGen, it’s clear that LAVIDGE is an agency you can trust.

We’d love to bring you into the LAVIDGE fold.

To learn more about our healthcare attitudinal research study, contact Dave Nobs.

Sign up for our LAVY email

and get our bi-monthly newsletter.