Sign up for our LAVY email

and get our bi-monthly newsletter.

Much emphasis has been focused in recent years on increasing the percentage of Americans who have health coverage—most recently reported in 2018 by the U.S. Census Bureau at 91.5%. That’s slightly lower than the year before, but still a significant portion of our nation’s population.

Recent research reveals, however, that simply providing Americans with public or private health insurance doesn’t always translate into patients using those benefits to access medical, vision or dental care at your facility.

Being aware of limiting beliefs, which prevent some of your patients from using your services as often as they could, can give you the edge you need to keep your practice profitably busy—and your patients in their best health.

These findings are part of a national consumer healthcare study LAVIDGE conducted in early 2020, with an amended survey in May 2020. The objective was to learn attitudes of healthcare consumers and define segments that share those attitudes—pre-pandemic and during the current COVID-19 outbreak.

The study uncovered four key healthcare consumer segments:

This is the second in a series of articles in which we reveal several “Light-Bulb Moments” our research uncovered.

Coverage among respondents to our study skewed slightly higher than the national rate of coverage. But at 95%, the difference is negligible and only 3.5 percentage points higher than recorded in the 2018 Census.

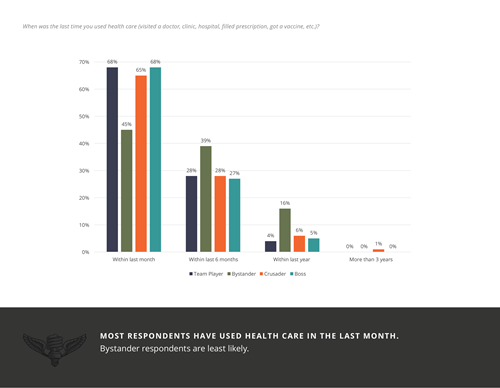

Don’t get us wrong. We’re not saying no one fully uses their benefits. Overall, 60% of respondents say they sought healthcare during the month before our study.

Don’t get us wrong. We’re not saying no one fully uses their benefits. Overall, 60% of respondents say they sought healthcare during the month before our study.

The rate at which each of the four segments accessed care, however, did vary. And because we uncovered the beliefs behind common health consumer behaviors, it’s possible to target—and market to—each group accordingly.

Team Player respondents, for example, are the most likely at 82% to have visited their doctor within the past six months. Additionally, 44% of this attitudinal segment say they saw a medical specialist during the same period.

Bystander respondents, on the other hand, were the least likely at 40% to say they visited their family doctor within the past six months, with only 22% saying they saw a medical specialist during that time. They were also less likely to see a doctor for any reason, from regular checkups to managing pain or chronic illnesses.

On the upside, only respondents from a single segment, the Crusaders, say they hadn’t seen a physician in more than three years. And, even then, only 1% of this segment reported that as being true.

Attitudes play a huge role in many decisions related to how consumers interact with the health care industry. When options are limited, however, consumers are forced to make decisions based on what’s available, regardless of whether it matches their personal preference.

This is certainly true for those whose life circumstances mean they must rely on government assistance such as the 18% who use Medicare, or the 9% of respondents who use a plan offered under the Affordable Health Act (ACA).

To a lesser extent, attitudes also have limited impact on coverage among those who participate in group plans at work. At 48%, nearly half of all respondents had health insurance through an employer, whether their own or that of a family member.

Many employers offer traditional plans, from Health Maintenance Organizations (HMOs) to Preferred Provider Organizations (PPOs). About 65% also offer high-deductible plans. Yet, less than one-quarter of all employers offer Health Savings Accounts.

This puts into perspective that only 21% of our study respondents say they have an HSA. The comparatively low rate of participation overall could be more of a reflection on options available to consumers than any bias against them.

We found, however, that attitudes toward healthcare in general made a huge difference in whether respondents enrolled in an HSA. At 31%, Bystanders respondents say they have just such an account. Considering that only 25% of employers offer HSAs, it’s worthy of taking note.

Perhaps the greatest opportunity for attitude to impact choice exists for the 14% of respondents who have private coverage. After all, aside from any cost limitations based on their income level or any factors outside of their control such as pre-existing conditions, their choices are less controlled and therefore more personal.

It’s easy to see how having inside knowledge about what health care consumers believe and how it translates into behavior is beyond golden. It’s an essential element for developing appropriate marketing messaging, creative and strategies that resonate with those you wish to reach.

Going it alone, especially in a post-pandemic market, can be risky for medical practices in 2020 and beyond. More than ever, choosing the best agency to partner with for consumer healthcare marketing messages has never been more important.

Consumer attitudes are changing, and you need an experienced team with significant industry experience combined with access to developing consumer insight based on what your patients believe.

You’ll find just that with LAVIDGE.

In fact, health care marketing is a core category at our full-service digital agency. We invest in primary research to keep abreast of consumer shifts in the healthcare industry.

For example, in 2016, we launched our first healthcare research study and published the results in 2017. We followed up by publishing an entire content suite of healthcare-related advice on how to apply the information to a host of marketing and advertising capabilities from Creative to Programmatic to help industry players achieve their goals.

Our current study digs deeper and provides updates on what’s most important to healthcare consumers today.

Finally, because our strong roster of current and past clients represents a wide range of organizations in the healthcare category including Banner Health, Blue Cross Blue Shield, Delta Dental, SimonMed Imaging, Sonora Quest Laboratories, and TGen, it’s clear that LAVIDGE is an agency you can trust.

We’d love to bring you into the fold.

To learn more about our healthcare attitudinal research study, contact Dave Nobs.

Sign up for our LAVY email

and get our bi-monthly newsletter.