Sign up for our LAVY email

and get our bi-monthly newsletter.

LAVIDGE conducted a national adult education research study post-pandemic. The objective was to learn attitudes of adult learners and define segments that share those attitudes.

The study uncovered three key adult education segments:

This is the first in a series of articles in which we reveal several “Light-Bulb Moments” our post-pandemic research uncovered about adult learners.

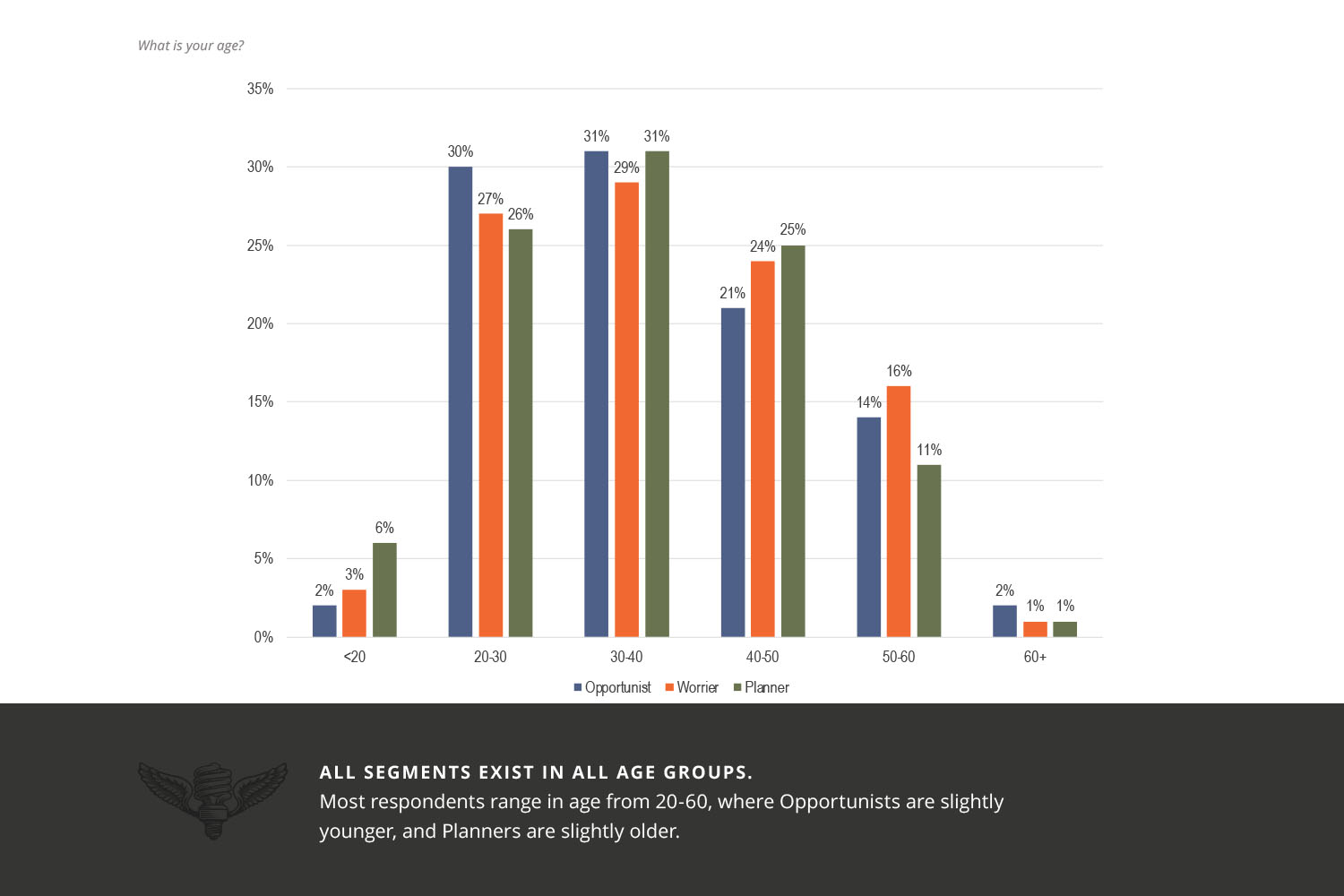

Opportunists are slightly younger and account for about 30% of those between the ages of 20 and 40, and 21% of respondents between 40 and 50.

Planners are slightly older, representing 31% of respondents between 30 and 40, and 25% of those between 40 and 50 years of age who participated in our study of how and why adults are pursuing additional education post-pandemic.

Worriers fall in between Opportunists and Planners in every age group identified, with a difference of less than 10 percentage points in either direction.

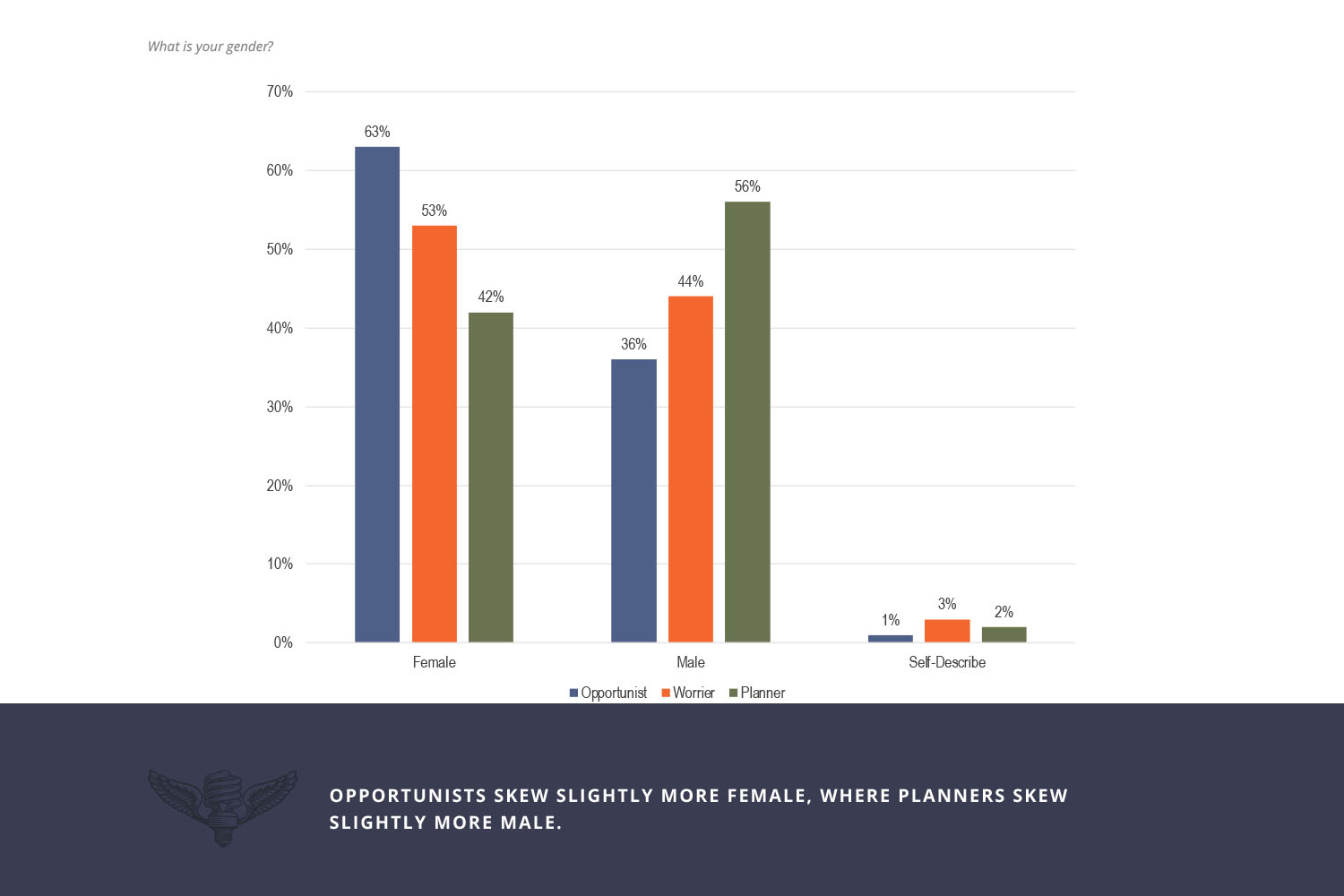

At 63%, female respondents were more likely to fall into the attitudinal segment of Opportunist compared to males (53%) or those who self-describe their gender (1%).

Males, at 56%, accounted for the greatest percentage of respondents who fall into the Planners attitudinal segment

Respondents who self-describe their gender were most likely to be Worriers (3%) with a percentage point less between each segment, giving Planners (2%) and Opportunists (1%) each.

All attitudinal segments also exist across household income levels. And while the disparity in earnings has little impact for those whose households earn between $75,000 and $99,000, the differences are most pronounced on either end of the spectrum of wage earners

Planners, for example, are more likely to report higher household income levels with 28% earning $100,000 or more each year. In contrast, at 16% Planners account for the lowest percentage of households which earn less than $25,000 annually.

Rankings for Worriers are nearly tied between the two lower household income segments with 28% of them earning less than $25,000 and 27% earning between $25,000 and $49,000 each year. At 14%, worries make up the same percentage within the two highest income levels (between $75,000 to $99,000, and more than $100,000 per year).

Opportunists account for 28% of respondents whose annual household incomes fall between $25,000 and $49,000, the highest of any attitudinal segment within that earnings range. Opportunists ranked second highest at 25% among households with an annual income of less than $25,000.

The least differences in attitude within an income bracket is found among households in which earnings are between $75,000 and $99,000. Opportunists make up 13% of this group, accounting for a single percentage point dip lower than both Worriers and Planners.

Consumer attitudes are changing, and you need an experienced team with significant industry experience combined with access to developing consumer insight based on what your audience of learners believe.

You’ll find just that with LAVIDGE.

In fact, education marketing is a core category at LAVIDGE. We invest in primary research to keep abreast of consumer shifts in the education industry, launching our first education study in 2018.

Finally, because our strong roster of current and past clients represents a wide range of organizations in the education category including Arizona State University, Rio Salado College, West-MEC, CampusLogic, Arizona Department of Education and International Sports Sciences Association, it’s clear that LAVIDGE is an agency you can trust.

We’d love to bring you into the fold

To learn more about our Adult Education attitudinal research study, contact Dave Nobs .

Sign up for our LAVY email

and get our bi-monthly newsletter.